UWP has been safeguarding occupational pension provision for its affiliated companies since 1993.

1993

Foundation590

Affiliated companies12217

Insured membersOur strengths

-

Asset investment

Occupational pension provision in Switzerland is based on the funding principle. Each insured member saves their own retirement assets over the course of their entire working life. It is therefore important for these funds to both provide an acceptable return, at an acceptable level of risk. UWP uses the three basic building-block investment forms – equities, real estate and bonds – no magic, but traditional sound investment work.

-

Customer proximity

Customer proximity means that UWP knows its customers and their needs and is at their disposal at all times. But customer proximity also means that UWP regularly provides information to improve understanding of developments in occupational benefits. Transparency is also a core element in fostering customer proximity.

-

Low costs

Every franc that does not need to be spent on risk and administration costs can be used for pension savings. UWP constantly looks at optimising all areas where further cost savings can be made. Our focus is on the cost of insuring against the risks of death and disability. The fewer benefit cases UWP has to bear, the lower the cost of the risk. The aim is to limit benefit cases as much as possible, through preventative measures and professional care management.

-

Innovation

From the beginning, UWP has always led the way with new solutions for its customers. Innovation is currently focused on digitalisation, where UWP aims to provide a unique solution throughout Switzerland for its insured members and affiliated companies.

-

Flexibility

UWP provides services for its customers "from entrepreneur to entrepreneur". We respond to demand with the greatest possible flexibility in pensions and investment solutions. The only limits are those set by the law.

-

Individuality

Thanks to state-of-the-art technology and a high level of specialist expertise, an individual approach does not necessarily mean higher costs. UWP is able to offer its customers tailored solutions that are no more expensive than typical off-the-shelf products. UWP adapts its pension solutions to its customers and not vice versa.

-

Independence

UWP is an independent collective foundation. It is committed to its affiliated companies and their beneficiaries, who are insured in the collective foundation. The Board of Trustees is made up of equal numbers of representatives of the affiliated employers and representatives of the collective foundation's insured beneficiaries. UWP can therefore be viewed as a kind of self-help organisation of insured members for insured members. It uses its commercial independence to offer its insured members the best pension solutions.

Board of Trustees

The Board of Trustees is composed of highly competent individuals with many years of experience who actively pursue UWP's goals and provide fair pension benefits to all insured members.

Philipp Spichty

Michael Quici

Raphael Cica

Sarah Kobler

Andreas Theiler

Roger Thomann

Yvonne Turi

Christian Willi

Emanuel Dos Santos

Office

Thomas Schneider

Nicola Eggimann

Stephan Eng

Caroline Inderbitzin

Claudia Kilchherr

Diana Kunnaht

Aurelia Stivala

Deha Akgün

Elisa Ukaj

Isabel Grieder

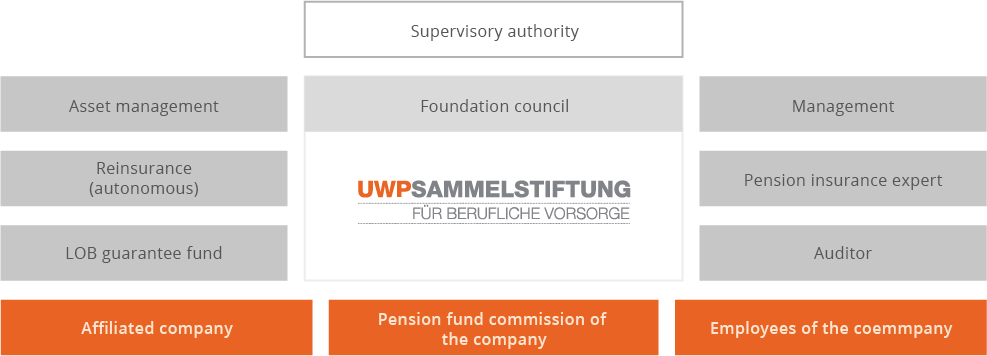

Our organisation

Foundation

2. July 1993

Constitution

Tax-exempt pillar 2 institution entered in the register of occupational benefits schemes of the Canton of Basel-Stadt within the meaning of Art. 80 et seq. SCC, Art. 331 SCO and Art. 48 para. 2 OPA

Management

Beratungsgesellschaft für die zweite Säule AG,

Dornacherstrasse 230, 4002 Basel

Auditors

Copartner Revision AG

St. Alban-Anlage 46, 4010 Basel

Pension insurance expert

Pittet Associates AG

Stampfenbachstrasse 7, 8001 Zürich

Reinsurance

Zürich Lebensversicherungs-Gesellschaft, Zürich

(Stop Loss Contract)

Asset management

Lies in the responsibility of the individual asset managers of the

asset pools

Supervisory authority

BSABB BVG- und Stiftungsaufsicht beider Basel (Supervisory Board for Occupational Pensions and Foundations of the Two Basels)

Eisengasse 8, 4001 Basel

Information and advice

Beratungsgesellschaft für die zweite Säule AG,

Dornacherstrasse 230, 4002 Basel

Data protection consulting

BaselLegal GmbH

Aeschengraben 29, 4051 Basel