Why worry about your pension provision, when you can rely on the care of UWP!

BVG2022

Fundamentals1.75%

Acturial interest rate5.2%

Conversion rate (all-inclusive)Pension provision at UWP

UWP specializes in the provision and operation of customized pension plans. With our selectable investment strategies and flexible benefit plan choices, optimal retirement solutions can be offered. As an enveloping fund, UWP pays one interest rate on the entire retirement assets of the insured and applies only one conversion rate to the entire retirement capital.

The strategies at a glance

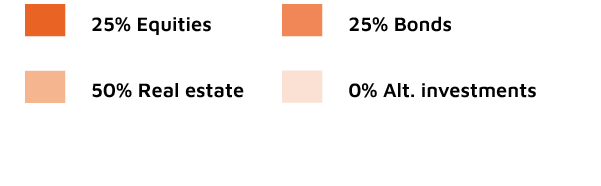

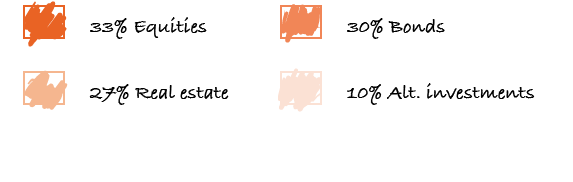

The dynamic investment solution.

| Investment philosophy | «actively managed» |

| Coverage ratio | 119.9% |

| Investment volume (in CHF 1,000) | 830'556 |

| Number of pension funds | 399 |

| Number of insured members | 4'203 |

| Performance YTD | 0.4% |

| Average returns 2020-24 | 3.33% |

Asset manager

Bank Baumann & Cie., IFS Independent Financial Services AG,

UBS Switzerland AG, Trafina AG

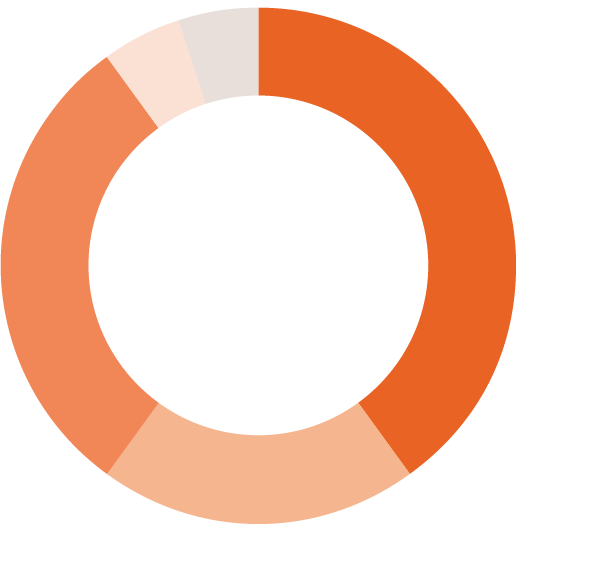

The cautious, balanced investment solution.

| Investment philosophy | «BVG 35» fund |

| Coverage ratio | 110.0% |

| Investment volume (in CHF 1,000) | 67'696 |

| Number of pension funds | 40 |

| Number of insured members | 558 |

| Performance YTD | 0.2% |

| Average returns 2020-24 | 2.30% |

Asset manager

BKB

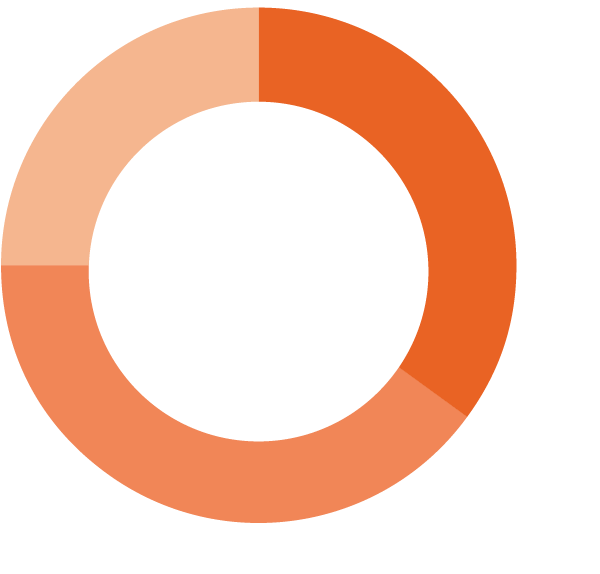

The sportier investment solution.

| Investment philosophy | «BVG 50» fund |

| Coverage ratio | 114.9% |

| Investment volume (in CHF 1,000) | 69'911 |

| Number of pension funds | 60 |

| Number of insured members | 141 |

| Performance YTD | 0.1% |

| Average returns 2020-24 | 3.83% |

Asset manager

BKB

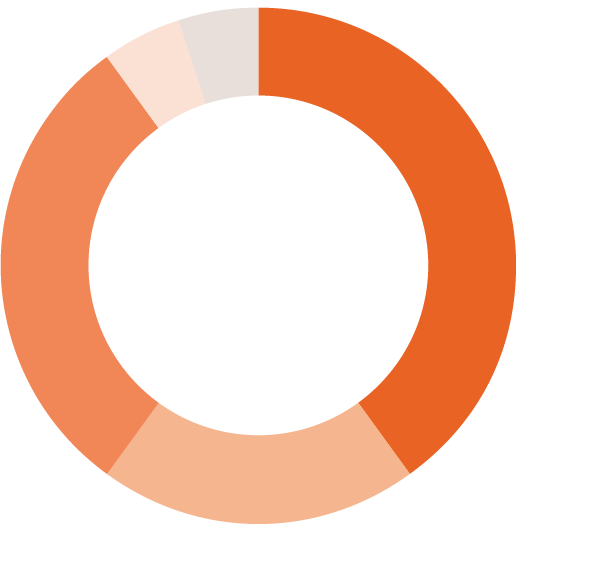

The continuously positive investment solution.

| Investment philosophy | «real estate plus» |

| Coverage ratio | 110.6% |

| Investment volume (in CHF 1,000) | 159'407 |

| Number of pension funds | 65 |

| Number of insured members | 1'177 |

| Performance YTD | 0.4% |

| Average returns 2020-24 | 2.67% |

Asset manager

Bank Julius Bär & Co. AG, Vontobel Asset Management AG

The bank-specific investment solution.

| Investment philosophy | «like bank- own PF» |

| Coverage ratio | 103.8% |

| Investment volume (in CHF 1,000) | 31'029 |

| Number of pension funds | 6 |

| Number of insured members | 343 |

| Performance YTD | 0.4% |

| Average returns 2020-24 | 3.00% |

Asset manager

CIC Bank

The self-determined, individual pension fund solution.

Self-determined, individual pension fund solution: own asset manager, own investment strategy, own real estate with the management service of the UWP Collective Foundation.