UWP stands for

UWP key figures at a glance

as at 31.01.2026

650

Pension funds30

Asset pools12353

Insured members3032 Mio

Balance sheet total117 %

Estimated cover ratio

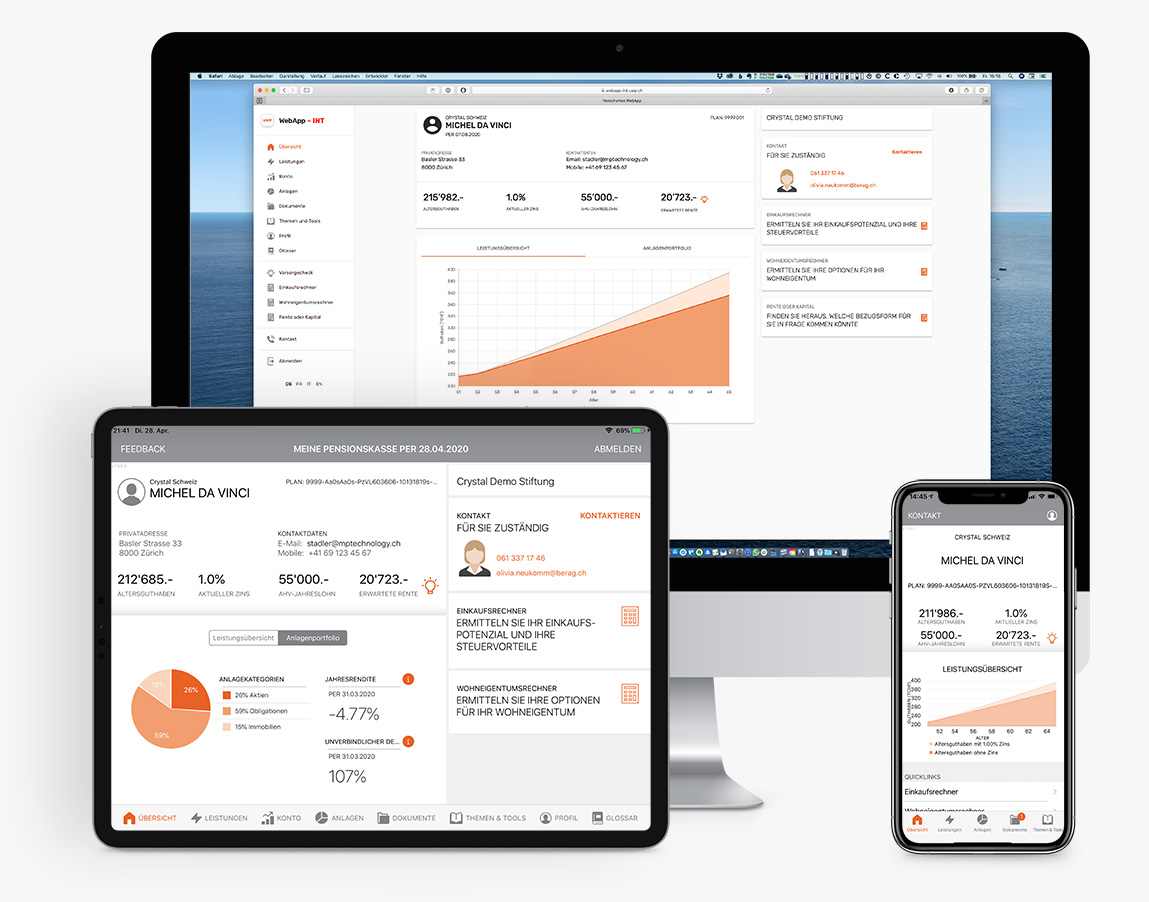

Your personal pension fund data at your fingertips at all times.

Discover our innovative insured members' app.

Now available for iOS and Android.